Buy Or Sell Your Home Without The Confusion

I'll help you easily navigate the real estate process by offering clarity with every step

EXPERT EDUCATION

SAVY ADVICE

EFFECTIVE COMMUNICATION

You Shouldn't Be Confused When Buying or Selling Your House

Don't feel intimidated during the process

because you lack real estate knowledge.

Protect yourself against uncertainty.

Hi,

I'm Shanequa Jones

Broker/Owner Best Solution Realty

I've been in your shoes before. I've purchased and sold a home and didn't understand the entire process.

I'm determined to make sure you have a better experience than me. I educate my clients before, during, and after so they never feel lost.

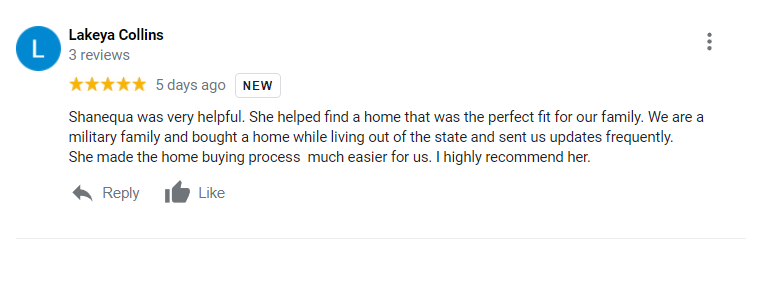

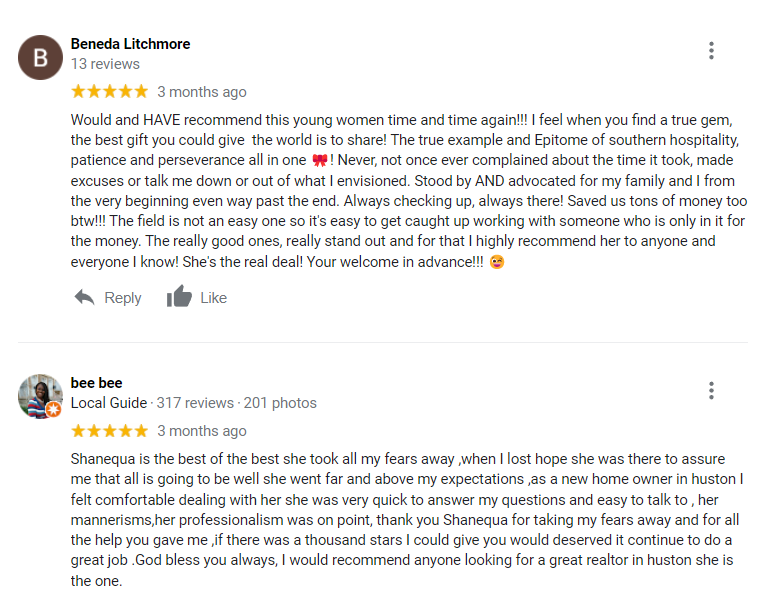

Testimonials

The Education Plan

Schedule A Call

Jump on a no-pressure call to see if I can help you.

Get A Plan

I'll create a strategy according to your needs and market data.

Buy or Sell

Buy or sell your house easily and stress-free.

Hiring An Education Oriented Realtor Vs Not Hiring One

Cons

Pros

ConClusion

Buying or selling your house shouldn't be a stressful ordeal.

Sources of stress can stem from lack of communication, feeling like you're being left in the dark, and not understanding real estate terminology.

It's important to work with a Realtor that values educating clients.